The skills to create unique goods and items, whether obtained over years of passed-down traditions or self-taught, are honed to produce a product desired by the public.

Although all these handcrafted products are unique by nature, they all have one thing in common: the exposure to product liability insurance claims.

As you focus on your trade and perfect your craft, you may not see how your product may cause damage or hurt someone. We have seen claims as minor as a cut obtained while handling your product, to a child choking on a button from a handmade doll.

Let’s get into the details of product liability to illustrate what it is and how it relates to you and your creative business.

What Is Product Liability Insurance?

Product liability insurance is designed to respond to bodily injury and property damage suits and claims arising from the use of your products that you become legally obligated to pay. If your product causes damage to someone or something, your product liability insurance should respond.

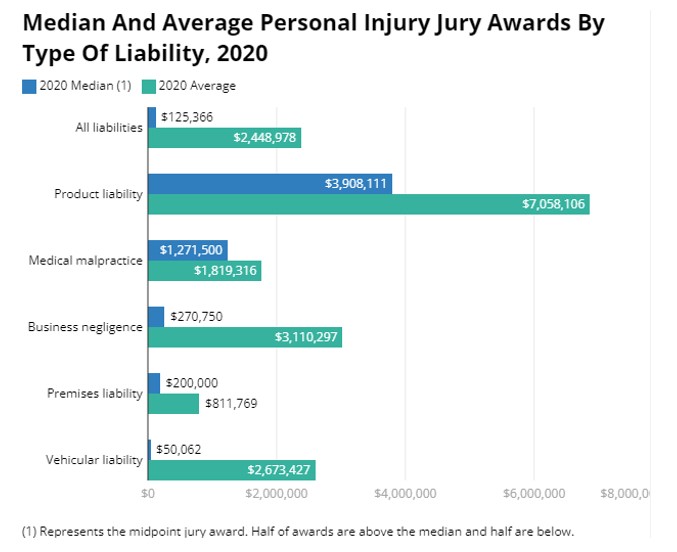

Why is product liability insurance important? You can see from the chart below that product liability coverage awards are the largest of all personal injury claims in 2020:

This type of coverage is so important, it’s only included on the ACT Pro policy.

When you open your doors for business, potential product liability claims also open. The cost to litigate a product liability claim can wreck a small business, even if they are not guilty. Product liability insurance can protect you from expenses that could cripple your business.

What Products Are Covered Under Product Liability Insurance?

It depends. Most Commercial General Liability (CGL) policies include product liability insurance with no restrictions on the products you sell. All your products may be covered if you have this type of liability policy.

If you have a CGL policy covering specified products, only products declared to the insurance company, approved by the carrier, and listed on the policy would be covered.

For example: If you have a CGL policy covering only ceramics, pottery, and jewelry, the policy will only respond to claims arising from specifically listed products. Or if you have a claim arising from a wood toy, which is not listed on the policy, there would be no coverage.

With policies that contain a product restriction, you are required to provide a list of products you want to be covered to the insurance company and have them listed on the policy. If it’s not listed, it’s not covered.

This type of policy can be problematic as you add products during the year and forget to report them to the insurance company. If you have a product liability policy with this restriction, it is important to review your “insured product” list and ensure it’s up to date.

Pro-Tip: It’s important to review any policy exclusions. Although the CGL policy may not require you to list the products you want to have insured, it may contain product and ingredient exclusions that are undesirable for the insurance company to cover.

Policy Definition Of “Your Product”

The Commercial General Liability policy defines “your product” as: any goods or products (other than the products that may be excluded in the policy) that are manufactured, sold, handled, or distributed by you or anyone trading under your name.

This definition includes containers, materials, parts, or equipment furnished in connection with your goods or products. It also includes warranties or representations made concerning the fitness, quality, durability, or performance of your product.

In addition, claims arising from the failure to provide warnings or instructions are included in the definition of “your product”.

Can you be sued for someone getting injured by a product you did not manufacture but only sold? Sure. Would your product liability policy respond? Possibly. There are several variables that could come into play in a product liability claim, but by definition, you sold the product; therefore, it is part of the “your product” definition. Accordingly, your product liability policy could respond to the claim.

Real-Life Claim Example

Two individuals purchased handmade sunscreen from a vendor. The individuals applied the sunscreen but received a 2nd-degree sunburn while at the beach. The individuals sued for damages and medical bills. The courts awarded the judgment in favor of the injured parties because the label did not state that they had to reapply the sunscreen.

Because the product label failed to instruct on how to properly use the product, thus causing the injury, the product liability portion of the coverage paid the claim.

The Right Coverages For Your Business

Many businesses don’t realize the product liability exposures they may have. It is critical to discuss the types of products you are manufacturing, distributing, or selling with an insurance professional to ensure that the product liability insurance is adequate to protect your business.

Although general and product liability insurance is a core coverage in protecting your business, three are other exposures that you have that need consideration. Property losses, cybercrimes, and employee injuries can cost thousands to mitigate.

There are additional coverages you should think about to protect you and your business. Below is a list of the most common a business owner purchases:

- Commercial Property Insurance

- Workers Compensation

- Excess/Umbrella Liability

- Cyber Liability Coverage

- Commercial Auto Insurance

- Tool & Equipment Coverage

For any insurance questions or coverages needed, please contact one of our licensed representatives at ACT Insurance. ACT Insurance is a national insurance agency catering to the needs of event vendors and handcrafted creative businesses of all sizes. We can be reached at 844.520.6991. Or you can email us at info@actinsurance.com.

Disclaimer: All insurance policies have conditions, limitations, and exclusions. Please refer to your policy for the exact verbiage and coverages provided.